What is the CO2 contribution?

CO2 contribution, or solidarity contribution, is a monthly amount payable to the NSSO by the employer, when the employee is allowed to make private use of the vehicle.

How much is the CO2 contribution?

According to the Royal Decree of 26 February 1981:

The amount of this contribution depends on the CO2 emission of the vehicle:

“3° The (non-indexed) monthly contribution, which shall not be less than EUR 20.83, shall be fixed at a flat rate as follows :

For petrol vehicles : ((Y x 9 EUR) – 768) / 12;

For diesel vehicles : ((Y x 9 EUR) – 600) / 12;

With Y the CO2 emission in grams per kilometre”

As apparent from the legal text, there is a calculated contribution, as well as a minimum contribution (non-indexed: 20.83 EUR).

The text continues:

“4° Electric-powered vehicles are subject to the minimum monthly contribution referred to in 3°.”

Both calculated and minimum contribution should be multiplied with the applicable indexation factor, to determine the payable monthly amount.

Example

BMW X1 xDrive, from https://www.press.bmwgroup.com/global/photo

| Make | BMW |

| Model | X1 |

| Version | XDRIVE 25E 180KW AUT |

| Motor type | PHEV |

| Fuel type | petrol |

| Emission WLTP | 15 g/km |

CO2 contribution

= ((15 x 9 EUR) – 768) / 12 = -52.75 EUR < 20.83

= 20.83 x 1.5046 (indexation coefficient 2023)= 31.34 EUR

Upcoming changes in the CO2 contribution

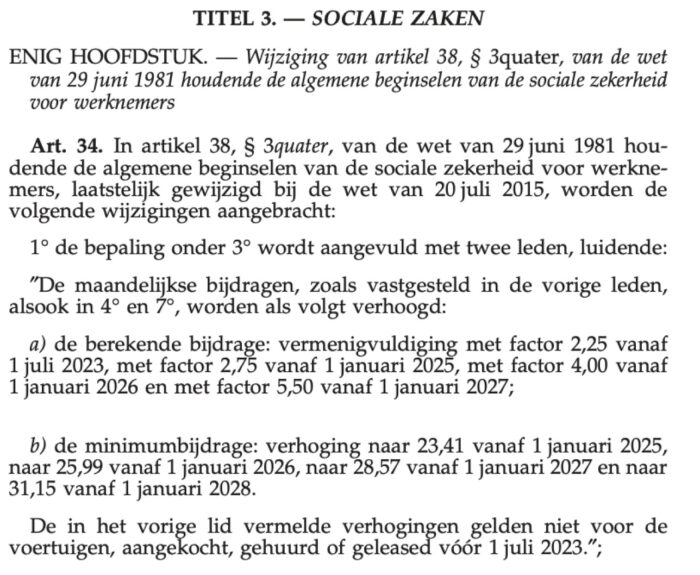

25 NOVEMBER 2021. – Wet houdende fiscale en sociale vergroening van de mobiliteit

Bron: https://www.ejustice.just.fgov.be/mopdf/2021/12/03_1.pdf#page=10

Increases as of July 1st, 2023:

(a) the calculated contribution: multiplied by factor 2.25 from 1 July 2023, by factor 2.75 from 1 January 2025, by factor 4.00 from 1 January 2026 and by factor 5.50 from 1 January 2027;

(b) the minimum contribution: increase to 23.41 from 1 January 2025, to 25.99 from 1 January 2026, to 28.57 from 1 January 2027 and to 31.15 from 1 January 2028.

A multiplier should be applied to the calculated solidarity contribution, and not to the minimum amount.

Confusion!

Two interpretations possible:

- Multiplication with factor applies for all combustion engines, including PHEV, and happens after application of minimum contribution (common interpretation by industry)

- Multiplication with factor applies for all combustion engines, including PHEV, but happens before application of minimum contribution (interpretation flagged by colleagues of TCOFleet)

NSSO has now confirmed: The second interpretation is the correct one: no multiplication of the PHEV minimum contribution.

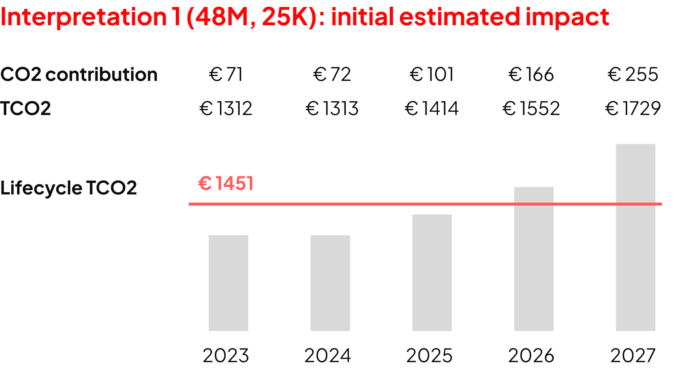

In the BMW X1 example:

Interpretation 1: Wrong

= ((15 x 9 EUR) – 768) / 12 = -52.75 EUR < 20.83

= 20.83 x 2.25 x 1.5046 = 70.52 EUR

Interpretation 2:

= ((15 x 9 EUR) – 768) / 12 = -52.75 EUR x 2.25=- 118.69< 20.83

= 20.83 x 1.5046 = 31.34 EUR

Impact on TCO

Initial estimated impact on lifecycle TCO for PHEV BMW X1 ordered after 01/07/2023 (interpretation 1):

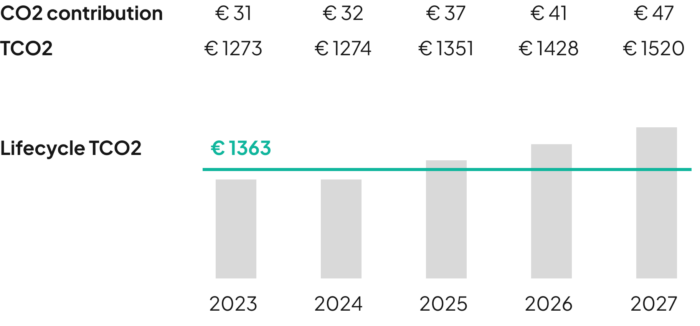

Actual impact on lifecycle TCO for PHEV BMW X1 ordered after 01/07/2023 (interpretation 2):

Conclusion

The impact of the upcoming changes in CO2 contribution on internal combustion engine (ICE) vehicles with a low emission is less than initially anticipated by the industry.

Of course, the fiscal deductibility of the vehicles still applies.

In terms of TCO, the example now shows a TCO increase of 19% in the last year of a 48 month contract, with an average TCO of 7% increase compared to the first month, compared to an initially estimated 36% increase in the last year, and a 14% increase on average.

How Headlight can help you

Headlight’s TCO calculations are already up-to-date with the latest regulation, and can help you:

- Calculate the correct TCO1, TCO2 or TCO3;

- Take into account future fiscal changes: during the contract, fiscal regulations makes the costs increase during the contract of the vehicle: with a weighted average TCO, the employer can take into account a correct metric;

- Make the employee responsible for the upcoming cost increase: show the average lifetime TCO during the ordering process.

Contact us at info@letitfleet.com or reach out to explore the platform with one of our experts.