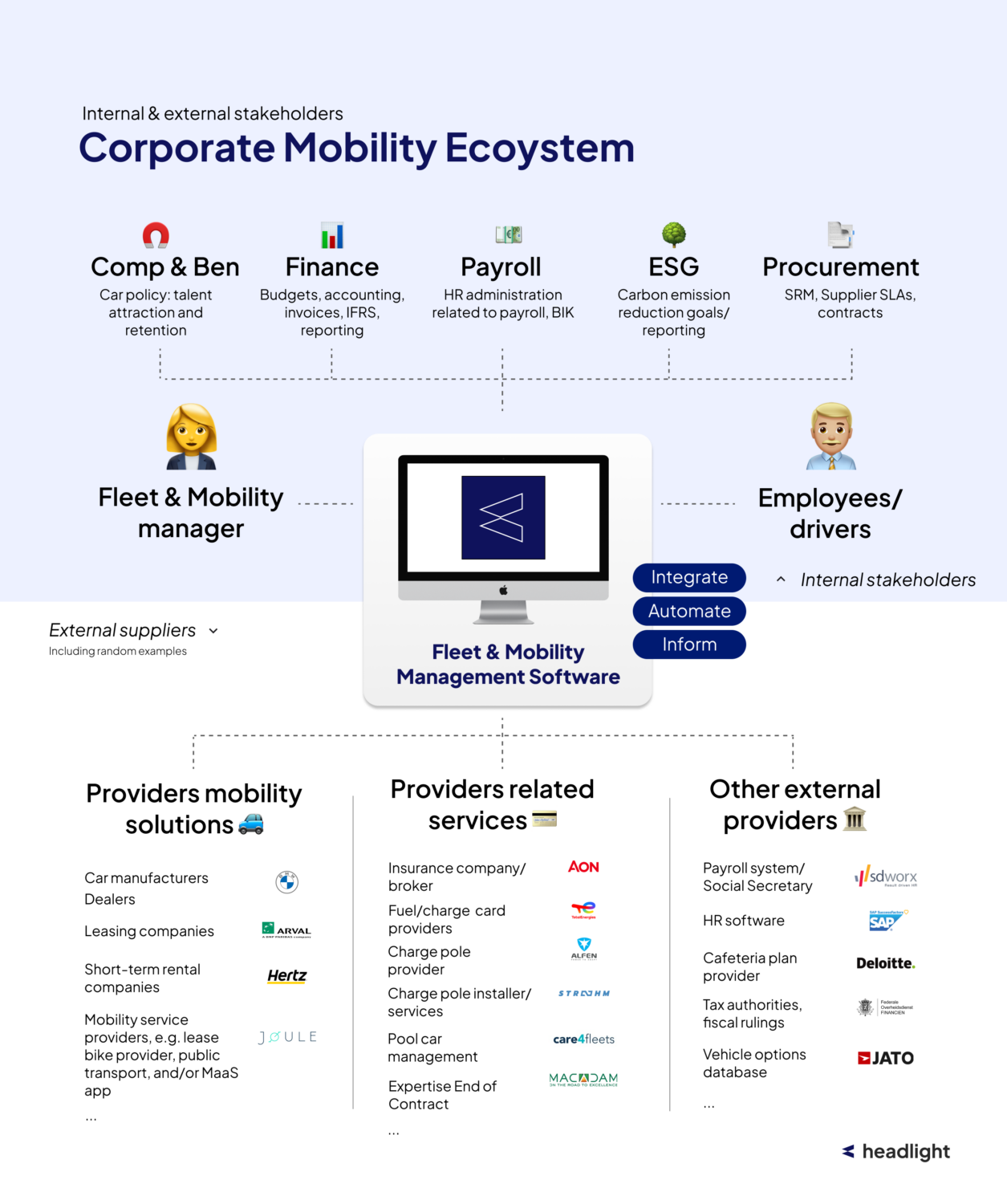

The Fleet & Mobility (F&M) ecosystem is becoming increasingly more complex, due to the advent of electric vehicles, and flexible alternative mobility options. As a result, the fleet & mobility managers has to deal with a growing number of suppliers, on top of the different internal stakeholders in his organisation. In this blog, we’ll provide an overview of the relevant stakeholders in the Fleet & Mobility Ecosystem, both internal and external.

The Core of the Ecosystem

Fleet & Mobility team

Of course, the fleet & mobility manager is the principal stakeholder, as this role executes the day-to-day operations. Operational tasks such as approvals, requests, administration, driver questions, supplier interaction, and policy analysis are some of the Fleet managers roles and responsibilities.

Employees/drivers

As the drivers are the consumers of the mobility services, they are the second principal stakeholder. The interaction is mainly condensed at the moment of mobility service purchases (or car ordering), though also during different operational processes. Examples include maintenance, tire changes, accidents, fuel card loss, etc. Of course, driver questions should be facilitated and answered.

Ecosystem Other Internal Stakeholders

The Fleet & Mobility team does not act on an island: the subject is at the intersection of many corporate domains.

Human Resources

First, there is a heavy HR link, since company cars are part of the salary package. Defining the car policy therefore means working together with Reward – or Compensation & Benefits departments. Next, the company car is subject to a Benefit in Kind (BIK), which impacts the wage calculations for the employees. Payroll should therefore be provided with up to date information. As promotions, demotions, new starters, and new leavers are also HR-matters, the fleet management team often is embedded in the HR department.

Finances & Procurement

As corporate fleet costs in many sectors in Belgium represent one of the biggest expense categories, next to the payroll, the finance department should be able to help set up budgets for upcoming quarters or years, as well as have a view of historical expenditures. Sometimes, specific IFRS reports are due to shareholders, or accounting requires a split of fleet-related costs (per employee/car, or per category, e.g. insurance, energy, rent, financial costs,..) to many different costs centers. As the fleet situation changes constantly, invoice control is required.

Finally, the procurement department is involved in supplier negotiations, contracting, SLAs and more. Given the large number of suppliers, the fleet & mobility manager should have a way to report on suppliers and their performance, both in costs and service.

ESG

In today’s organisations, sustainability is a priority, with electrification of the fleet as one of the most externally visible elements. Therefore, Environmental, Social and Governance-teams want insights on the fleet emissions. With the upcoming Corporate Sustainability Reporting Directive (CSRD) by the European Union, organisations will be forced to report on their carbon emissions: The CSRD will compel companies to substantiate both their baseline emissions and targets for emission reductions [1].

Ecosystem: internal stakeholder overview

| Human Resources |

|

| Finance |

|

| Procurement

|

|

| ESG |

|

Fleet & Mobility Ecosystem

Ecosystem External Stakeholders

Providers of Mobility Solutions

The primary external suppliers are the organisations that provide the mobility service to the employees: leasing companies, rental companies, and providers of alternative mobility.

Leasing cars need to be purchased, delivered, and maintained: many of the operational processes therefore include interaction with the dealer or garage. For car manufacturers, specific conditions/discounts can be obtained to lower the leasing costs. These conditions are to be renewed yearly, and may or may not be subject to a procurement negotiation.

Providers of Related Services

Many providers exist in the market ecosystem that offer services related to (electric) company cars: fuel card/charge card providers, charging installation services, insurances, etc. Leasing companies often offer the possibility to bundle many of the “related services” as part of their operational leasing package: fuel/charge cards, charging poles, insurances,.. However, many organisations choose to unbundle one or more of the services, to work with their fixed supplier for e.g. insurances, or to save on the premium charged by leasing companies for providing these services.

Other External Providers

Finally, different other external parties are implicated in the Fleet & Mobility Management and its ecosystem. For instance, Benefit/Payroll-related software providers need to facilitate the exchange of critical information with the F&M departement.

| Provider Mobility Services |

|

| Provider Related Services |

|

| Other External Providers |

|

Conclusion

It is clear that the ecosystem of Fleet & Mobility is growing increasingly complex. The Fleet & Mobility department is expected from internal stakeholders to provide seamless services and fully integrated reporting. However, without the appropriate tooling, this is a very labour-intensive task, especially since information is directly outdated. At Headlight, our mission is to bring about the seamless organisation of corporate mobility. We accomplish that by integrating with the different external suppliers, and provide the information, communication and operational tasks the internal stakeholders need as automated as possible.

Want to learn more? Book your free demo!

[1] oliverwyman.com