Company Cars: Introduction

In the recent Arval Mobility Observatory Barometer, 90% of Belgian companies, especially larger ones, believe their fleet size will be stable or grow. HR-related reasons stands out: attracting and retaining talented people has become an essential difficulty for businesses. Indeed, mobility options, and company cars especially, are an important asset in the renumeration package. In cases where vehicles are not part of the default renumeration, an increasing amount of businesses are planning to make cars available to employees via e.g. salary sacrifice plans.

It is clear that (electric) vehicles will continue to be offered to Belgian employees in the foreseeable future. However, fleet managers nowadays are faced with a number of challenges. As vehicle catalogue prices have increased, and fiscal legislation is evolving, controlling fleet costs is an important challenge. Next, employees are increasingly demanding flexibility, and in combination with fleet electrification, the operational workload for fleet managers has expanded significantly.

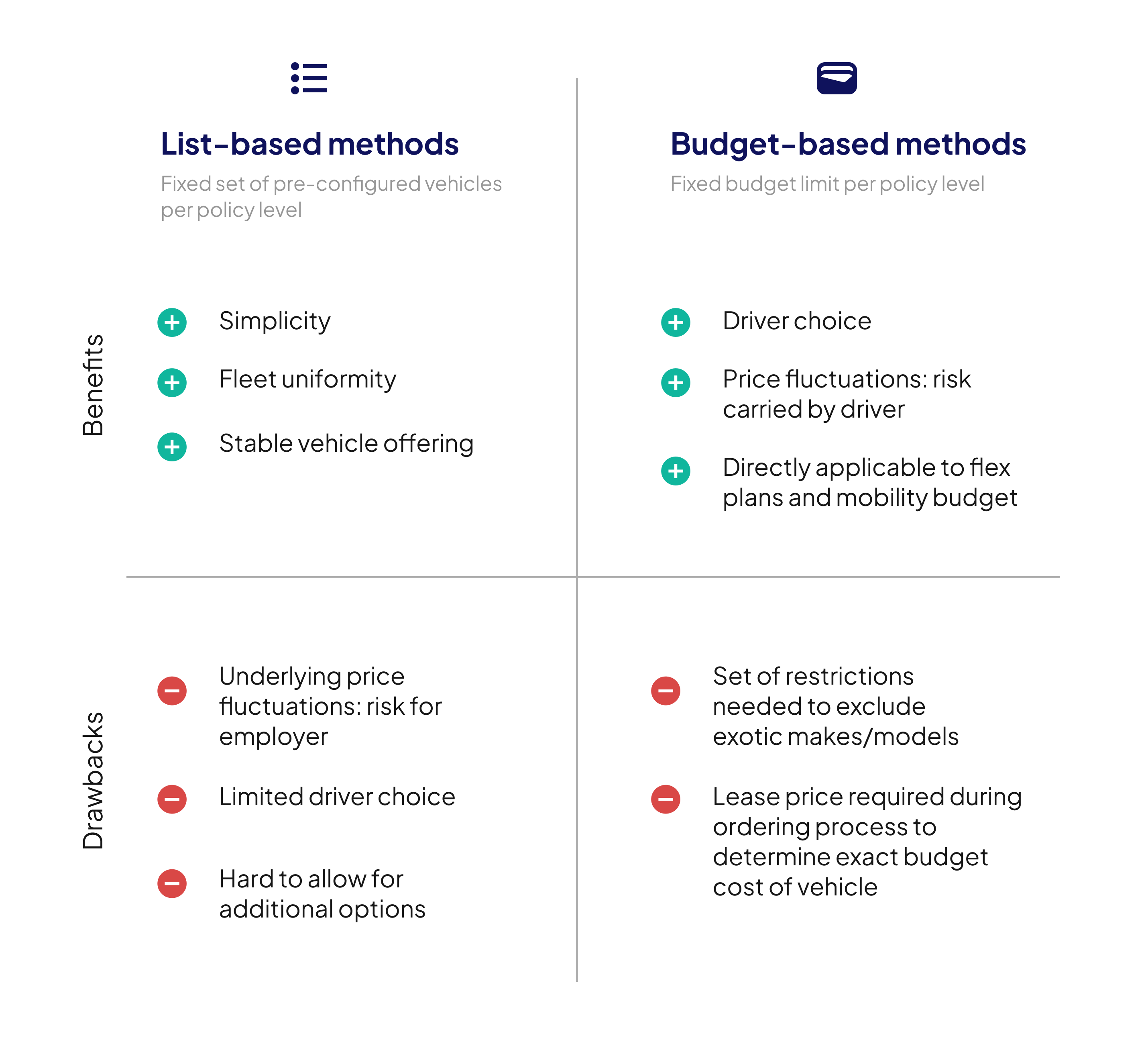

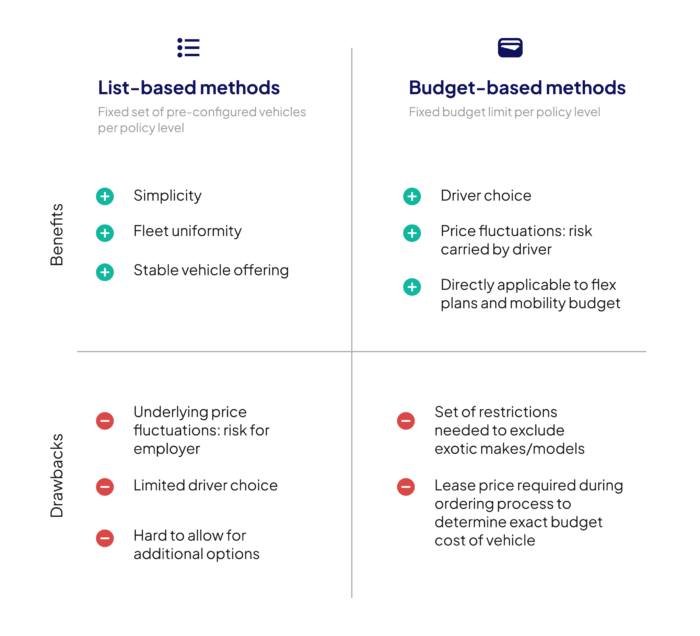

The question arises on what the options are when offering vehicles for employees. In this white paper, we shed light on the different ordering methodologies we’ve come across in the market, each with their benefits and drawbacks.

Ordering methodologies

Car list-based methods

What?

In car-list based methods, companies will specify one or more company car models per role/policy level for employees to choose from when a new vehicle can be ordered.

How?

- Per role/policy level, the different requirements, such as the purpose of the vehicle (e.g., executive vehicle, sales), the expected mileage, and any specific features or equipment necessary for the job, will be used to define vehicle specifications.

- Next, a single or subset of configured vehicle models that meet the specifications can be determined, taking into account additional constraints such as environmental impact, budget, employee preferences and other trade-offs.

- Employees eligible for ordering a new company car will be able to select from the list, without any further customisations.

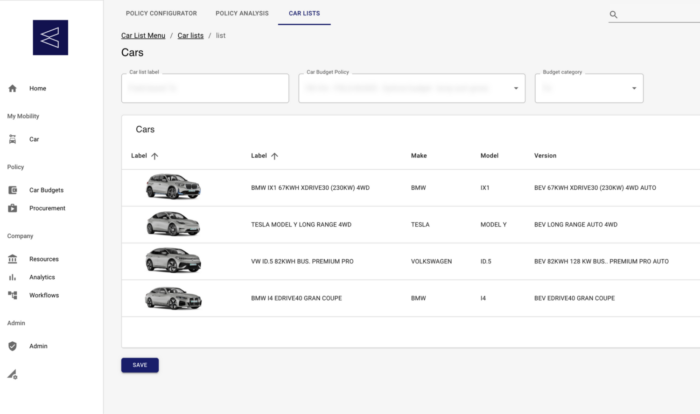

Example of a car list configuration in Headlight. In this case: the employee can choose from 4 vehicles that are made available within her/his policy level.

Budget-based methods

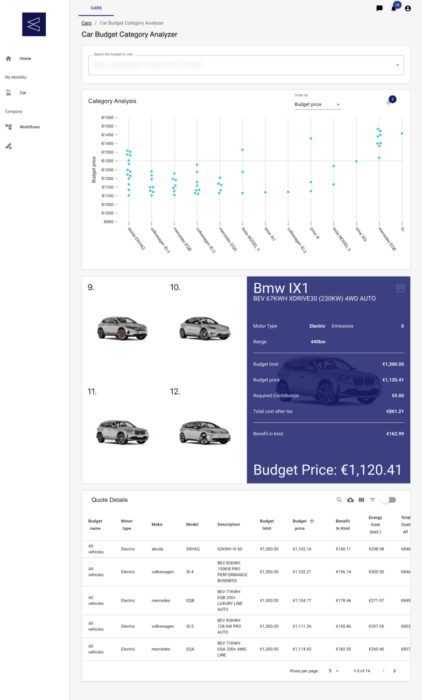

Example of a car budget level analysis: for each vehicle, one can see whether it its within budget, and if an personal contribution would be required.

What?

In budget-based methods, an employee has the freedom to order the vehicle as she/he wants, as long as the vehicle fits within the budget made available to her/his policy level.

How?

- First of all, the budget definition should be determined. In today’s changing fiscal climate, preferred methods include the fiscal costs of the vehicle, in a Total Cost of Ownership (TCO) approach.

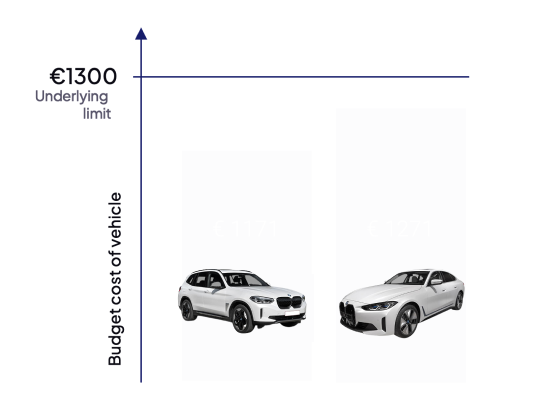

- Second, a budget limit for each of the policy levels should be determined. In most cases, certain key models are guaranteed to fit in the budget.

- Employees can proceed with ordering a company car if a configured vehicle fits within the applicable budget limit for her/his policy level.

Examples

Car list

Employee can choose between a BMW iX1 or a BMW i4.

No distinction for the employee based on true vehicle cost for employer (TCO2).

Budget based

Employee options:

- BMW iX1 + € 129 budget/month remaining (for options)

- BMW i4 + €29 budget/month remaining (for options)

Other models within budget

Note

In this example, the budget cost of the vehicles is expressed in Total Cost of Ownership (TCO2). TCO2 comprises of all before-tax elements, including lease price, CO2 contribution, non-recoverable VAT, energy costs and insurance costs. In addition, the lost tax benefit on rejected expenses is added and translated to a before-tax amount. In that way, TCO2 can be treated as a 100%-deductible before-tax cost, which allows for easy application with regard to personal contributions, mobility budgets or cafeteria plans. For more information, contact us at info@letitfleet.com.

Summary

Employers most often want to provide flexibility to employees, but within clear boundaries. Therefore, hybrid approaches are gaining popularity in favour of car lists, because it offers most of the wanted benefits. Learn more about hybrid approaches to the car list vs budget-based ordering in our next blog.

Feel free to contact us at info@letitfleet.com or reach out to discuss!